Despite producing only a fraction of the food it consumes, the United Arab Emirates has emerged as one of the most important transit hubs in the global food trade. The reason is not agricultural capacity, but the country’s growing dominance in logistics, infrastructure, and trade facilitation, which has positioned it as a critical connector in international supply chains.

As global food systems face mounting pressure from climate disruptions, geopolitical tensions, and price volatility, the ability to move goods quickly, reliably, and at scale has become as important as production itself. This is where the UAE’s strategic model stands out.

Table of Contents

A Strategic Location Turned Into a Trade Engine

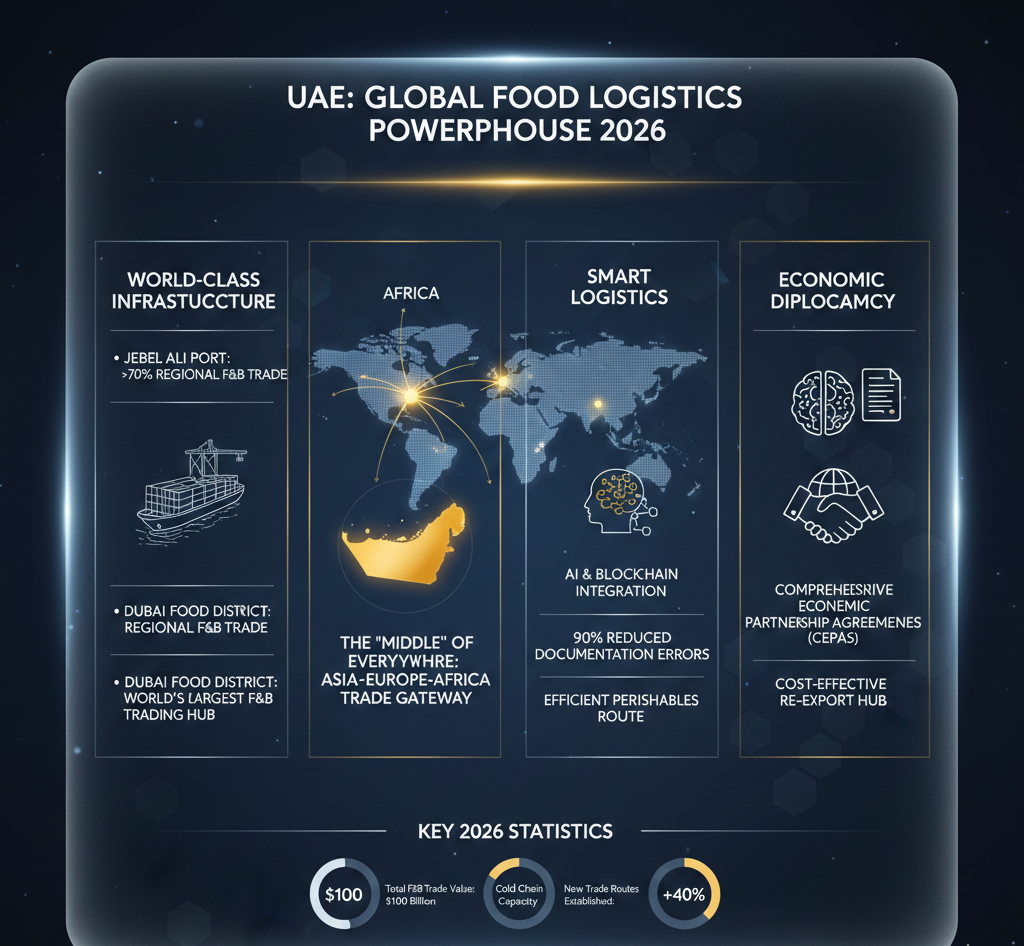

Situated at the crossroads of Asia, Africa, and Europe, the UAE lies within short transit time of some of the world’s fastest-growing consumer markets. Geography opened the door, but it is sustained investment in infrastructure that has allowed the country to capitalise on this position.

Rather than serving as a destination market alone, the UAE functions as a re-export and redistribution hub, enabling food and agricultural products to move seamlessly across regions.

Ports and Airports Form the Backbone

The UAE’s logistics strength rests on a tightly integrated, multi-modal transport network:

- Jebel Ali Port remains the country’s primary maritime gateway, handling a significant share of food and beverage trade by value.

- Dubai and Abu Dhabi airports rank among the world’s busiest cargo hubs, offering fast connections for high-value and perishable goods.

- Extensive road links allow efficient onward distribution across the Gulf and wider Middle East.

This combination allows traders to balance speed and cost through sea–air and air–sea logistics models, a capability that has become increasingly valuable amid global supply chain disruptions.

Cold Chain and Technology Drive Reliability

Food logistics places exceptional demands on storage, handling, and traceability. The UAE has invested heavily in:

- Temperature-controlled warehouses

- Specialised terminals for perishable cargo

- Digital tracking and data-driven inventory systems

These capabilities reduce waste, improve transparency, and meet rising regulatory and consumer expectations around food safety and compliance. Importantly, the same logistics backbone also supports pharmaceuticals, e-commerce, and other time-sensitive industries.

Policy Focused on Scale and Efficiency

Government policy has played an enabling role by prioritising efficiency over direct market participation. Initiatives such as the Food Cluster Economy aim to integrate farms, processors, logistics providers, and retailers into coordinated ecosystems, reducing duplication and accelerating project execution.

Large-scale developments like the Dubai Food District, scheduled to roll out in phases toward 2027, are designed to expand cold storage, processing capacity, and logistics infrastructure, further strengthening the UAE’s role as a regional and global trade hub.

Logistics, Not Food Production, Is the Real Story

While headlines often suggest that the UAE is becoming central to global food supply, the underlying reality is more precise. The country is not a major food producer, nor does it control global food markets. Its influence lies in movement, storage, and redistribution.

In a world where supply chains are under sustained strain, the UAE’s ability to offer speed, reliability, and regulatory clarity has turned logistics into a source of competitive advantage. Food trade is simply the most visible expression of this broader logistics strength.