Table of Contents

Why This Distinction Matters More Than Businesses Realise

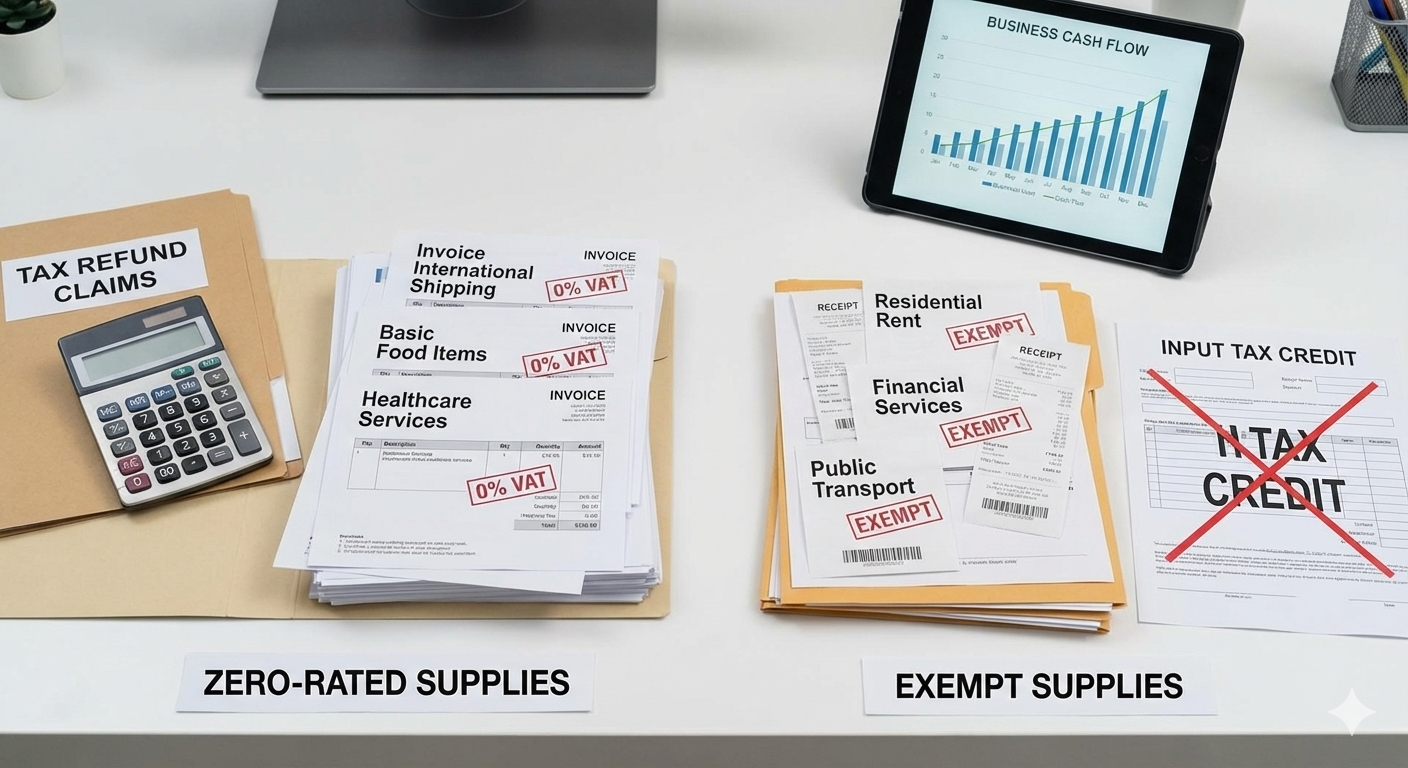

For many UAE businesses, a recurring VAT challenge is determining whether a supply is zero-rated or exempt. While both treatments result in no VAT being charged to the customer, the similarity is only superficial. The underlying VAT consequences are fundamentally different.

In practice, the difference has a direct impact on recoverability, profitability, input tax planning, contract structuring, and compliance risks. The Federal Tax Authority (FTA) treats these two categories very differently, and so should every company operate in the UAE whether you are a service provider, manufacturer, real estate developer, Free Zone entity, or an import-export business.

Zero-Rated Supplies: Taxable, but Charged at 0%

Zero-rated supplies are fully taxable under UAE VAT law, just at a rate of 0%.

This subtle but crucial point means the business maintains the right to recover input VAT on related costs. In essence, they are treated as normal taxable transactions for compliance and reporting purposes.

The UAE uses the zero-rate mechanism primarily to keep essential, globally connected, and socially important sectors competitive. Export-driven businesses especially rely on this category, as it eliminates additional tax burdens that would otherwise disrupt international pricing.

Even though the customer is charged 0%, the supplier must maintain the same documentation standards as any other taxable supply: tax invoices, contracts, export proofs, transport documents, customs paperwork, and compliance with all conditions outlined under UAE VAT law. Zero-rated does not mean “lighter compliance” it means “taxable without charging VAT.”

Common Categories of Zero-Rated Supplies in the UAE

The list is precise and defined in the VAT Executive Regulations. Common examples include:

- Exports of goods

- Exported services (when strict conditions are met)

- International transport of passengers and goods

- First supply of residential property (within 3 years of completion)

- Certain educational services

- Certain healthcare services

- Specific categories of investment gold

Each category has its own conditions and failing those conditions means the supply becomes standard-rated.

The Real Operational Impact of Zero-Rating

If your business primarily provides zero-rated supplies, your VAT returns often reflect:

- Higher input VAT claims

- Lower output VAT liability

- More frequent VAT refund positions

- A cleaner audit trail (when documentation is well maintained)

Zero-rating is a financial advantage but only when businesses meet the conditions precisely.

Exempt Supplies: Outside the Scope of Input VAT Recovery

Exempt supplies, on the other hand, represent a distinct treatment altogether. When a supply is exempt, the supplier cannot charge VAT, but they also cannot recover input VAT on goods or services used to make that supply.

This creates important practical consequences. Businesses engaged in both exempt and taxable activities must perform input VAT apportionment, ensuring that only VAT related to taxable supplies is claimed. For companies in sectors like financial services or residential property management, this directly affects operational margins. Exempt supplies tend to reduce recoverability and therefore must be managed with careful pricing and internal allocation models.

While exempt transactions appear simpler at first glance no VAT charged, no VAT invoiced they often require deeper internal analysis to ensure expenses are split correctly and that VAT positions are defensible during audits. The absence of VAT does not mean the absence of compliance responsibility.

For full guide: Financial Services VAT Guide

The Operational Consequences: Why Classification Affects Every Department

From a consultant’s perspective, the most recurring issue we encounter is not incorrect VAT charging, but the downstream effect of misclassification. If zero-rated supplies are incorrectly treated as exempt, companies lose the right to input VAT recovery. If exempt transactions are treated as zero-rated, input VAT may be reclaimed incorrectly leading to penalties and repayment obligations.

The impact extends across business functions:

- Finance teams must track recoverability carefully

• Procurement teams need to understand which purchases support exempt activities

• Contract drafting teams must specify whether amounts are VAT-inclusive or VAT-exclusive

• Operations teams handling exports must maintain impeccable documentation

These operational touchpoints show that classification is not a theoretical VAT concept, it is something that affects day-to-day business decisions and long-term financial health.

Practical Examples That Clarify the Difference

While the definitions differ legally, what matters most are the day-to-day operational consequences.

Here is the practical, business-focused comparison:

- VAT Charged to the Customer

- Zero-rated = VAT charged at 0%

- Exempt = VAT not charged at all

- Input VAT Recovery

- Zero-rated = Input VAT fully recoverable

- Exempt = Input VAT is blocked

This is the single most important difference for companies.

- VAT Classification in the Return

- Zero-rated = Reported as taxable supplies

- Exempt = Reported separately as exempt supplies

Zero-rated supplies contribute to your taxable turnover; exempt supplies do not.

- Impact on Refund Eligibility

- Zero-rated businesses often file refund claims

- Exempt-heavy businesses rarely qualify for refunds

- Audit Sensitivity

The FTA pays attention to:

- Export documentation for zero-rated items

- Input VAT claims for mixed-supply businesses

- Correct classification of financial and real-estate transactions

Misclassification is one of the most common triggers for FTA questions.

The Real-World Scenarios Where Companies Get This Wrong

To make the distinction more tangible, the following examples provide real-world context based on common UAE business scenarios:

Example 1: Export of Services (Zero-Rated)

A consultancy firm provides services to a client located outside the UAE. If all zero-rating conditions are met including evidence of the customer’s residence outside the UAE and confirmation that benefit is enjoyed outside the UAE, the supply may qualify as zero-rated. The consultancy can then recover input VAT on costs like staff training, software, and professional expenses.

Example 2: Residential Leasing (Exempt)

A developer who leases long-term residential property cannot charge VAT to tenants. Equally, the VAT paid on construction, maintenance, or property management relating to that residential block generally cannot be recovered. This directly influences pricing strategy and long-term ROI.

Example 3: Export of Goods (Zero-Rated)

If a business sells goods to a customer abroad and can prove export through customs documents, the sale is zero-rated. This preserves competitive global pricing without sacrificing recoverability on import VAT, freight charges, or storage costs.

Example 4: Local Passenger Transport (Exempt)

Taxi services, metro transport, and local passenger bus routes fall under exemption. They do not charge VAT on fares and cannot reclaim VAT on fuel, maintenance, or fleet-related expenses affecting sector profitability.

These examples show how the classification directly influences cashflow, leading to either savings or costs depending on the nature of the business activity.

How to Ensure You Are Classifying Supplies Correctly

The safest approach for businesses is to create internal VAT classification maps simple internal documents that outline which of their supplies fall under taxable, zero-rated, or exempt categories. This ensures consistent treatment across teams and reduces the risk of mismatch during filing or audits.

Companies should also ensure that:

- Contracts specify VAT treatment clearly

• Supporting documents match the classification

• Input VAT recoverability rules are applied correctly

• Export proofs are collected on time

• Apportionment calculations are maintained for mixed supplies

A well-designed internal process reduces the risk of unintentional misclassification, which is one of the most common causes of VAT penalties in the UAE.

Small Distinction, Big Consequences

Zero-rated and exempt supplies may appear similar, but their implications are fundamentally different. Zero-rating supports growth by allowing VAT recovery on business expenses, while exemption removes both charging and recovery. Misunderstanding the two can affect profitability, compliance, and strategic planning.

For UAE businesses, the goal is not simply to charge the correct VAT rate, but to build an internal structure that supports accurate classification, proper documentation, and recoverability planning. When done correctly, VAT becomes not a burden but a predictable, manageable part of corporate financial governance.