Table of Contents

VAT Refunds Are More Than a Reimbursement – They Are a Compliance Test

VAT refunds in the UAE often look simple from the outside: you paid more input VAT than output VAT, so the difference should come back to you. In practice, however, VAT refunds are one of the most carefully reviewed processes by the Federal Tax Authority (FTA). A refund request is, in essence, an invitation for the FTA to inspect your records, your documentation standards, and your overall VAT compliance culture.

When done correctly, VAT refunds improve cashflow and reduce the burden on companies with high setup costs, large imports, or long project cycles. When done poorly, they lead to rejection, delays, or even formal tax assessments.

When Businesses Become Eligible for VAT Refunds

A refund position arises when input VAT exceeds output VAT during a tax period. This imbalance is common in industries with significant upfront costs or recurring VAT expenses that do not immediately generate corresponding taxable revenue.

Common scenarios include:

- A company is newly registered and incurs setup or capital expenditure.

- A business is heavily import-dependent and pays large VAT amounts through customs.

- The volume of zero-rated supplies is high, especially in export-driven sectors.

- Input VAT is high due to commercial rent, professional fees, or materials procurement.

- Reverse charge on imports is declared, and the related VAT becomes recoverable.

Businesses often misunderstand the refund mechanism. It is not limited to exporters or start-ups; it applies to any taxpayer whose recoverable input VAT legitimately exceeds the VAT charged on their taxable supplies. What matters is accuracy, supporting evidence, and adherence to the VAT law.

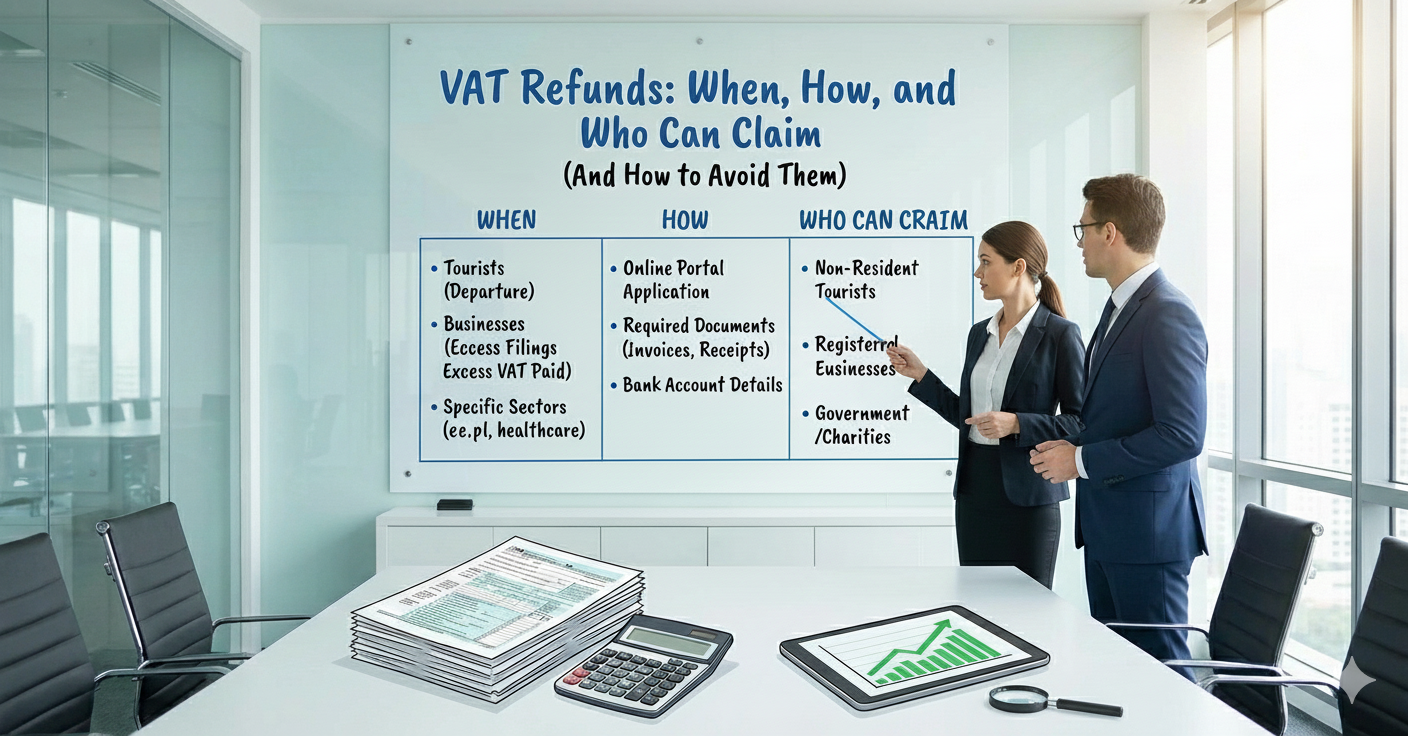

Who Can Claim VAT Refunds in the UAE

The right to request refunds is wide-ranging but governed by specific eligibility conditions. The following taxpayer categories are permitted to apply for refunds through EmaraTax:

Standard VAT-Registered Businesses

Any entity registered for VAT in the UAE can claim a refund if it is in a credit position after filing a VAT return. This is the most common scenario and applies to companies of all sizes.

Tourists (Refund at Point of Sale)

Through the “Tax Refund for Tourists Scheme,” eligible tourists can claim VAT refunds on purchases made in the UAE.

Foreign Governments & International Organizations

Certain foreign missions and diplomatic entities may request VAT refunds under specific agreements and reciprocity conditions.

UAE Nationals Building a New Residence

Nationals constructing new private residences can apply for VAT refunds related to building materials and contractor fees.

Expo Participants (Historical Category)

Previously available during Expo 2020, subject to strict eligibility. Not generally applicable after the event period.

Non-Resident Businesses

Foreign businesses with no place of residence in the UAE (but incurring UAE VAT) may apply for a refund under the “business visitor refund scheme.”

Each category requires different documentation and review processes, but the common denominator is proof evidence that VAT was incurred correctly and for an eligible purpose.

How to Submit a VAT Refund Request (Using EmaraTax)

The UAE uses the EmaraTax platform for all refund requests. The filing process is straightforward, but the preparation is not. Before you begin, your VAT return for the relevant period must show a credit balance.

The filing steps generally follow this structure:

File Your VAT Return First

Refunds can only be requested after the VAT return for that period is submitted.

The credit position must be shown on the “VAT201” return summary.

Access the VAT Refund Form (VAT311) onEmaraTax

Log into: EmaraTax Portal

From the Taxable Person dashboard, select VAT Refund Request – VAT311.

Complete the Refund Application

The form requires:

- Amount you wish to reclaim

- Confirmation that there are no outstanding penalties

- Bank account details (IBAN certificate often required)

- Supporting documents for high-value VAT items

Accuracy matters because the refund form must match the credit amount shown in the VAT return.

Submit the Application and Await FTA Review

Refund review typically involves:

- Verification of invoices

- Matching customs imports

- Checking reverse charge declarations

- Validating supplier TRNs

- Reviewing the consistency of tax codes

Refund requests may be approved, partially approved, or rejected with explanation.

Receive the Refund (Upon Approval)

Once approved, the refund amount is transferred to your UAE bank account. The timeline varies, but well-documented applications typically move faster.

Common Reasons VAT Refunds Get Delayed or Rejected

Refund rejections do not necessarily mean non-compliance; often, they simply highlight documentation gaps. However, some recurring issues consistently lead to delays:

- Input VAT claimed on invoices lacking required fields

- Missing export documentation for zero-rated goods

- Incorrect or incomplete reverse charge postings

- Use of personal customs codes instead of the company’s TRN

- Unreconciled customs declarations

- VAT on blocked items being included as recoverable

- Mismatched names between bank account and VAT registration

The FTA is strict about documentation because refund requests inherently carry more risk than normal VAT filings. A refund suggests that the business is asking the government to return money; therefore, the compliance threshold is understandably higher.

Preparing a Strong, Audit-Ready Refund File

A well-prepared refund file is the difference between swift approval and prolonged correspondence. Strong refund applications share several characteristics:

- Invoices are complete, compliant, and easily traceable.

- Import VAT is reconciled with customs declarations.

- Export evidence is consistent and timestamped.

- Reverse charge entries are clearly matched to foreign supplier invoices.

- High-value recoveries (commercial rent, capital assets, contractors) are supported by contracts and payment proofs.

Although not legally required, many businesses prepare a refund reconciliation pack that summarises the logic behind the claim. This is a consultant best practice that often speeds up FTA review.

VAT Refunds Reward Strong Internal Controls

A VAT refund request is not just a request for reimbursement; it is an examination of your VAT governance. Companies that maintain disciplined record-keeping, accurate tax codes, and consistent reconciliations rarely face issues with refund approvals. Those that treat VAT casually often find themselves facing rejections, resubmissions, or extended FTA reviews.

In the UAE’s maturing VAT environment, the strength of your refund application reflects the strength of your VAT culture. When handled correctly, refunds become a predictable, beneficial cashflow tool for businesses.